When you enter any type of market for the purpose of make money so trading is the plan for your income you can trade in monthly, weekly or Intra-day trading. Other than it should be a Forex market, Stock market or Crypto market first think you know before inter in any market is Chart Reading or Chart Analysis. YES….

Chart patterns play an important role in any useful technical analysis and can be a powerful asset for any trader at any level. Actually chart reading play an important role to know about when and when the market make its Resistance, Support, and Breakout and predict about the next move of the market. Sometimes you are right and sometimes you are wrong about prediction about the move of the market.

But don't worry no-one is perfect

If you want to learn to recognize these patterns early, they will help you to gain a real competitive advantage in the markets. Like volume, support and resistance levels, ROI, and Fibonacci Retracements can help your technical analysis trading, stock chart patterns can contribute to identifying trend reversals and continuations.

Always use 4Hour candle or 1Day Candle to create chart.

So let’s start to learn about the Charts.

1. Pennant - A pennant shape was created when there is a significant movement in the stock, which is followed by a specific period of consolidation and this creates the pennant shape due to the converging lines. A breakout movement then occurs in the same direction as the big stock move. The flag patterns and tend to last between 1 and 3 weeks. There will be significant volume at the stock, volume is weaker in the pennant section and volumes growth in volume at the breakout.

2. Cup and Handle - You can see in the image, the market following pattern is look alike cup and handle shape that’s why we call it a Cup and Handle pattern. In general, the right-hand side of the diagram has low trading volume, and it can last from seven weeks up to around 65 weeks.

3. Ascending Triangle – This type of pattern you can see when the market trend is Upward. Sometimes it can be created at time of reversal at the end of a downward trend. But commonly it always shows a bullish time of the market or stock whenever they occur.

4. Triple Bottom – The triple bottom is used to analysis the reverse position the long downward trend of the market. The triple Bottom occurs when the price of the stock creates three distinct downward prongs, at the same price level, before making breakout and reversal the trend.

5. Descending Triangle – The Descending triangle always shows the continuation of the downtrend of the bearish market. Sometimes you can see as a reversal during at the upward market. But it is always considered as a continuation of the bearish market.

6. Inverse Head and Shoulders – You can use head and shoulder pattern to identify the reversal of the downward trend. It gets the name from having one longer peak, forming the head, and two level peaks on either side which create the shoulders. Sometimes you can call it Head and Shoulders Bottom also.

7. Bullish Symmetric Triangle - The symmetrical triangle pattern is easy to spot thanks to the distinctive shape which is developed by the two trend lines which converge. This pattern occurs by drawing trend lines, which connect a series of peaks and troughs. The trend lines create a barrier, and once the price breaks through these, a very sharp movement in price follows.

8. Rounding Bottom – We can use this pattern to understand the or demonstrate the Long-Term showing that the stock is moving from a downward trend towards an upward trend instead. It can be last anytime in several months or years. It looks like a Cup and Handle pattern but there is no handle in this pattern. You can also called a “Source Bottom”.

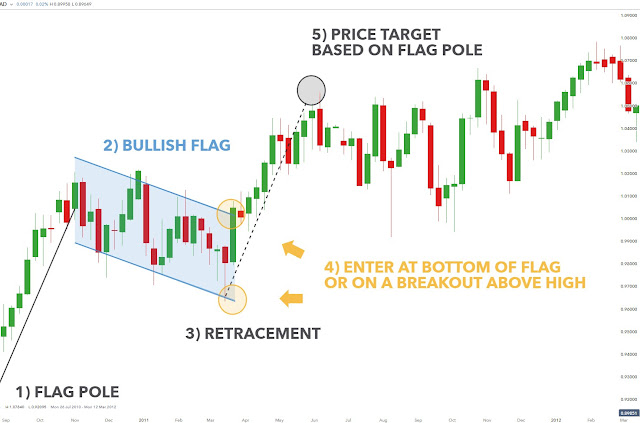

9. Flag Continuation - The flag stock chart pattern forms through a rectangle. The rectangle develops from two trend lines which form the support and resistance until the price breaks out the flag will have sloping trend lines, and the slope should move in the opposite direction to the original price movement. Once the price breaks through either the support or resistance lines, this can create the buy or sell signal.

10. Double Top – You can call it Double Top and Double Bottom because of shape of the pattern. These two reversal patterns illustrate a security’s attempt to continue an existing trend. Upon several attempts to move higher, the trend is reversed and a new trend begins. These chart patterns formed will often resemble what looks like a "W" (for a double bottom) or an "M" (double top).

The double-top pattern is found at the peaks of an upward trend and is a clear signal that the preceding upward trend is weakening and that buyers are losing interest. Upon completion of this pattern, the trend is considered to be reversed and the security is expected to move lower.

11. Bearish Symmetric triangle - The symmetrical triangle pattern is easy to spot thanks to the distinctive shape which is developed by the two trend lines which converge. This pattern is created by drawing trend lines, which connect a series of peaks and troughs. The trend lines create a barrier, and once the price breaks through these, it is usually followed by a very sharp movement in price.

12. Falling Wedge - The wedge chart pattern signals a reverse of the trend that is currently formed within the wedge itself. Wedges are similar in construction to a symmetrical triangle in that there are two trend lines - support and resistance - which band the price of a security.

The wedge pattern differs in that it is generally a longer-term pattern, usually lasting three to six months. It also has converging trend lines that slant in an either upward or downward direction, which differs from the more uniform trend lines of triangles.

There are two main types of wedges — falling and rising — which differ on the overall slant of the pattern. A falling wedge slopes downward, while a rising wedge slants upward.

So guys these are the few types of the chart which is very helpful to trader to trade in any type of market.

Trending

6/recent/ticker-posts

Types of the Important Chart Pattern, which every Beginner Trader should know.

market expertss

July 03, 2021

You may like these posts

Latest Crypto News

Binance Stop It's services in "Stock Token Trading.

MicroStrategy CFO thinks Crypto is better than Fiat.

CRDT Airdrop is starting, So Go and Won 250 CRDT coin.

Again Chaina Make a Statement to banned Crypto.

Historic movement in Crypto Industry. El Salvador Become the First Country who Adopt Bitcoin as Legal tender.

Selected Coins

Popular Posts

How to Trade in Leverage Tokens on Binance

February 13, 2021

How to trade Spot and Margin on Binance.

January 02, 2021

Random Posts

3/random/post-list

Popular Posts

How to Trade in Leverage Tokens on Binance

February 13, 2021

How to trade Spot and Margin on Binance.

January 02, 2021

Copyright ©

Market Expert